The insurance industry is currently engaged in their annual strategic planning and budgeting, a process made even more important by the pandemic. The need to sell and grow is critical to survival in this evolving environment. Further investment in digital transformation will be crucial for many of these insurance companies. All of it driven by the increasing need to meet evolving customer expectations.

Compliance and regulatory functions are being pushed harder than ever before to address the emerging challenges and new investment will also be required. Additionally, new data protection and privacy laws have surfaced. To comply with the California Consumer Privacy Act (CCPA) and the European Union’s General Data Protection Regulation (GDPR) many insurers are heavily investing both time and money. The regulatory landscape will continue to shift. Will insurers be able to respond?

Regional differences in investment – highlight regional concerns #

A recent report from Celent[i] (Integrated Insurance Ecosystem - The Next Generation Insurer) highlights:

The insurer of tomorrow will be a technology-focused enterprise, augmenting current experiences with digital tools and automation, and with collaborations with partners for success.

To address this, life insurers are trying to innovate through technology investments along their traditional end-to-end value chain. This includes marketing/sales to underwriting to onboarding to servicing/operations and finally claims management.

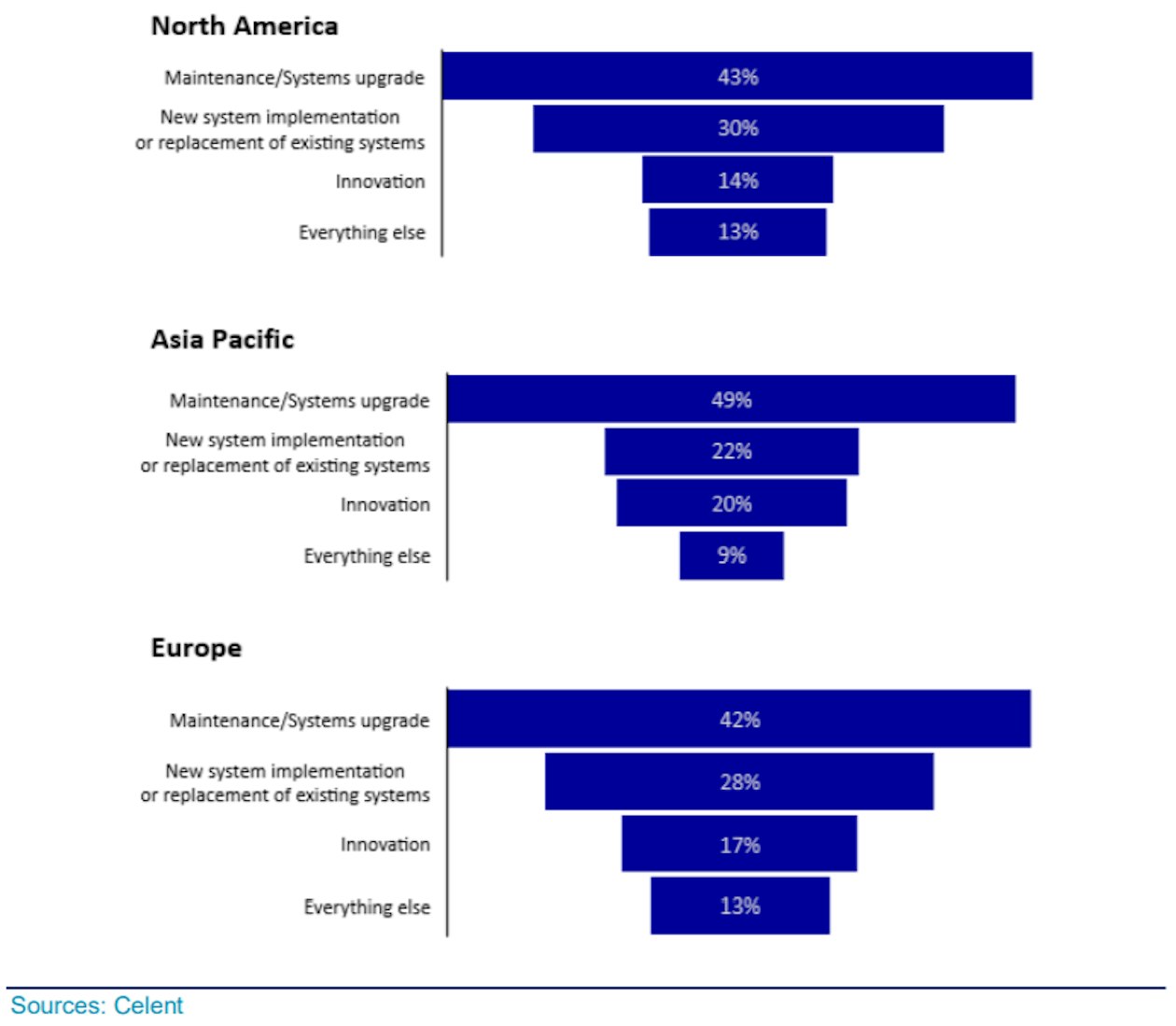

Insurers are making heavy investment in maintaining current systems, investing in new systems and innovation. The following graph from Celent[i] provides a global view of those investment areas which indicates that innovation will happen at different paces for different regions.

Customer empowerment is the insurance product of the future #

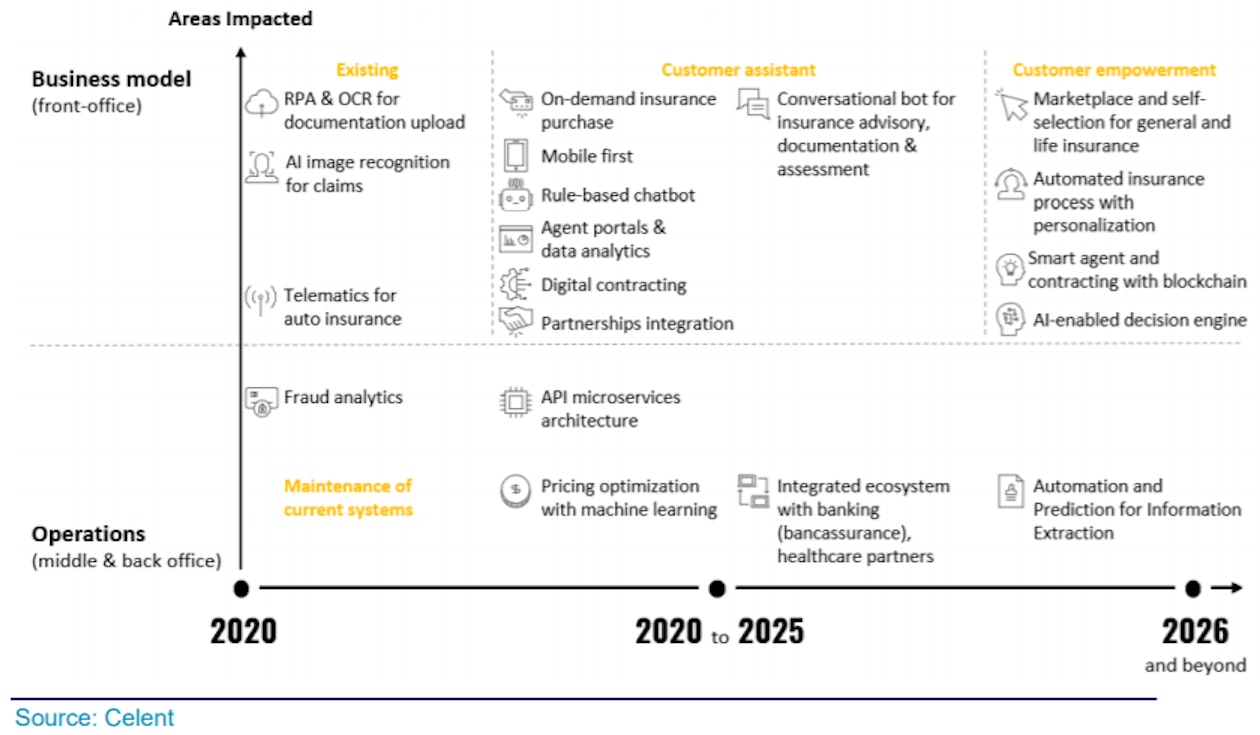

In Celent’s[1] view of the ideal state for the next-generation insurer, customer empowerment is envisioned to be the insurance product of the future. Customers will be given the choice to select when, where, who, what, and how they purchase insurance, with insurers providing the support to meet customers’ needs. Moving beyond 2020, insurers will need to address these issues via comprehensive and integrated developments in both front-office and middle/back office.

New developments in end-to-end technology to address customer empowerment #

IT spending will begin to increase again #

Celent also outlines in their new September 2020 report[ii] called IT Spending in Insurance - Making Sense of the Future Insurer's Technology Investments why they expect insurers to continue to investigate how they can lower their IT cost, notably thanks to higher cloud adoption. The data suggests a slight decrease in 2020 spend related to implementing new systems and transformation/innovation initiatives likely related to the pandemic. However, beyond just getting companies through the pandemic, many of those new initiatives are in support of the overall goal of meeting and exceeding heightened customer expectations. And, the spend continues to increase again in 2021 and 2022.

New systems and innovation grow in importance #

3 key changes in the future of life insurance #

Looking ahead we can only imagine what types of new insurance products and investment vehicles may exist. Tomorrow’s customer engagement model is likely to look very different than todays. McKinsey believes that several trends show promise for the life insurance industry in the next decade. In their September 2020 report[iii] called The future of life insurance - Reimaging the industry for the decade ahead, McKinsey cites that the life insurance industry faces a pivotal, dual opportunity: the chance to fulfill growing customer needs while returning to profitability and growth.

To achieve these goals, McKinsey reports that leading life insurers will outperform in 3 key areas in the decade ahead. These include that ability to (1) personalize every aspect of the customer experience; (2) develop flexible product solutions suitable for a challenging regulatory and interest-rate environment and (3) reinvent skills and capabilities.

Additionally, McKinsey expects to see life insurance transition from the traditional “assess and service” model and shift toward “prescribe and prevent”. They describe how the data individuals share today is currently being used to assess risk and provide standard products and care.

Increasing volumes of shared client data will revolutionize product design #

However, as more data is freely collected from external sources and devices in the future, insurers will be able to assess risk and price much differently. This will enable them to develop new highly dynamic usage-based products with pricing sophistication. The lines between life, wealth and health products will begin to blur and allow for tailored coverages and health services for families. And finally, this should lead to huge servicing cost reductions as new Robo and DIY channel capabilities include the ability to approximate human empathy and conversation.

Seizing the dual opportunity to exceed customer expectations and grow #

The COVID-19 pandemic will pass, and new obstacles will face our industry in the years ahead. Growth and cost reduction will likely remain a fundamental challenge for many global life insurers and product innovation will play a key role in that battle. They will be required to make the necessary investments in new systems and innovation.

Although the challenges may seem great, the opportunities appear to be even greater for those global insurance companies who embrace the challenges and forge ahead!

Footnote:

[i] “Integrated Insurance Ecosystem – The Next Generation Insurer”, Celent, August 26, 2020

[ii] “IT Spending in Insurance – Making Sense of the Future Insurers’ Technology Investments”, Celent, September 2020

[iii] “The future of life insurance – Reimaging the industry for the decade ahead”, McKinsey & Company, September 2020