Cenfri and Equisoft Research Reveals the Biggest African Insurance Distribution Challenges #

African insurance distribution is complex. Structures and approaches vary across the region. Cultural norms, technological acceptance and economic factors create challenges that all insurance industry stakeholders are struggling with.

In order to help insurers, brokers and banks across Africa Equisoft commissioned Cenfri to conduct research to understand the biggest challenges in insurance distribution and which solutions would be most impactful.

The research included quantitative and qualitative studies with underwriters, brokers, banks and regulators in 15 African countries. It involved the cooperation of over 30 insurance associations around the continent.

What the Insurance Automation in Africa report revealed #

The participating underwriters, brokers and banks provided insights into a proliferation of challenges and opportunities in the African insurance market. However, three vital and interconnected issues stood out.

Issue #1: Legacy technology negatively impacts all stakeholders #

A significant share of underwriters struggle with inefficient processes and lack of digitalisation, likely due to the number and age of systems they use. The challenges manifest themselves as delays in the claims processes, handing most client engagement over to the distributors and underwriter’s reliance on simple products.

These legacy issues are felt by all stakeholders due to poor integration between underwriters, brokers and banks. In the end, it is the end-customer who suffers through poor experiences from sales to service to claims.

Issue #2: Technology challenges contribute to the low trust problem in African insurance #

Because legacy technology and integration issues create poor CX it isn’t surprising that customers report very low levels of trust in insurance, underwriters, and brokers. While banks fair a little bit better there is still a big issue with consumer confidence in insurance in the region.

When legacy technology often prevents speedy processing of applications, service requests and especially claims consumer trust problems arise. Underwriters have tried to address part of the issue by creating and relying on a proliferation of simple products which reduce time to approval of an application to just a few days.

Unfortunately, underwriters, brokers and banks are less capable of quickly handing claims. This suggests either internal inefficiencies when it comes to dealing with more complex processes, or issues in getting the necessary documents, etc. from individuals.

Having paid premiums for so long, customers are extremely frustrated if the benefits they expected upon submitting a claim are either not delivered or get delayed by slow and painful processes.

Issue #3: Needed accelerated product innovation is hampered by lack of digitalisation #

Banks, brokers, and underwriters don’t see eye-to-eye on the type of products the market requires. Underwriters are happy to continue to provide simplified products that address basic needs and are appropriate for consumers with low sophistication when it comes to insurance and low-tech capabilities.

These policies are easy to explain and make application decisions happen more quickly. But they don’t fit all needs.

Brokers and banks want a more appropriate mix of potentially more complex products to meet the needs of their potential customers. The problem is, underwriter’s aging legacy systems slow down product innovation and may be discouraging the creation of new, more complex offerings.

The shape of underwriter and distributors’ technology landscape #

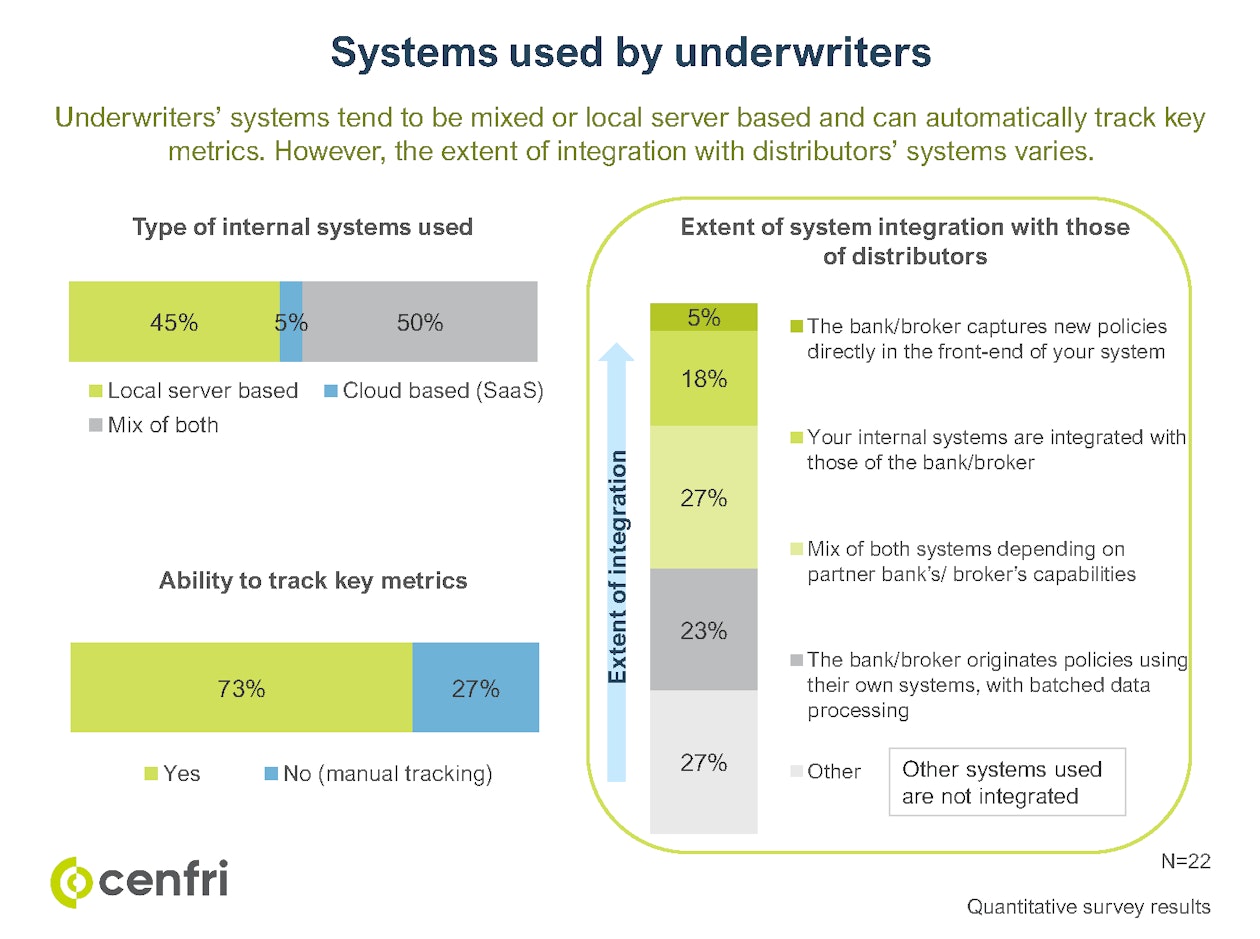

The Cenfri research revealed that most underwriters have more than one policy administration system, and that they tend to be relatively old and expensive to maintain. In many cases the systems are more than ten years old and poorly integrated with distributor systems.

These aging core systems will often require time-consuming code-changes to create new products or even modify existing ones. And they often don’t work with modern APIs that enable digital sales and service solutions to access client data in real time. Ultimately, the shortcomings of these systems are a significant contributor to the challenges the channel faces.

How long is modernization of core systems expected to take? #

The channel understands the importance of evolving their tech landscape to become more agile and responsive to customer expectations. Most underwriters have recognized the importance of going digital, and either have digitized, or are in the process of digitalizing, their business.

Underwriters are digitalizing their agency management systems, sales channels, and are working to improve their systems’ integration with third party systems. On the distribution side, the focus is on improving data analytics to better target and service customers, as well as digitalizing sales channels. Brokers in particular identified opportunities around digitalizing their internal systems, claims processes and improving the digital capabilities of their staff.

The benefits of these efforts will be enormous. Unfortunately, the challenge facing all stakeholders is that most underwriters believe the process will take another 3-5 years to complete.

Wrap up #

The Equisoft and Cenfri Insurance Automation in Africa report clearly shows that the channel is in a state of transition. Modernization of core systems and front-end tools has begun, but the journey is not finished. The drawbacks created by existing legacy systems are contributing to the lack of progress in building trust with consumers and creating innovative products that the market is looking for.

Those stakeholders who can accelerate their digital transformation will see the biggest benefits in growing sales and increasing customer satisfaction. It’s time to remove the technology obstacles that block the path to increased penetration of insurance in Africa.

To find out more about what initiatives African insurers, brokers and banks are prioritizing in their digital transformations read the research report.