How is low digitalisation holding back insurance distribution? #

– Liberty Nobula, Founding Partner & Consultant, WHL Consultants.

Research on African life insurance distribution conducted by Equisoft and Cenfri revealed that underwriters, banks, and brokers in Africa typically rely on manual processes for selling insurance, onboarding & engaging with clients, and settling claims.

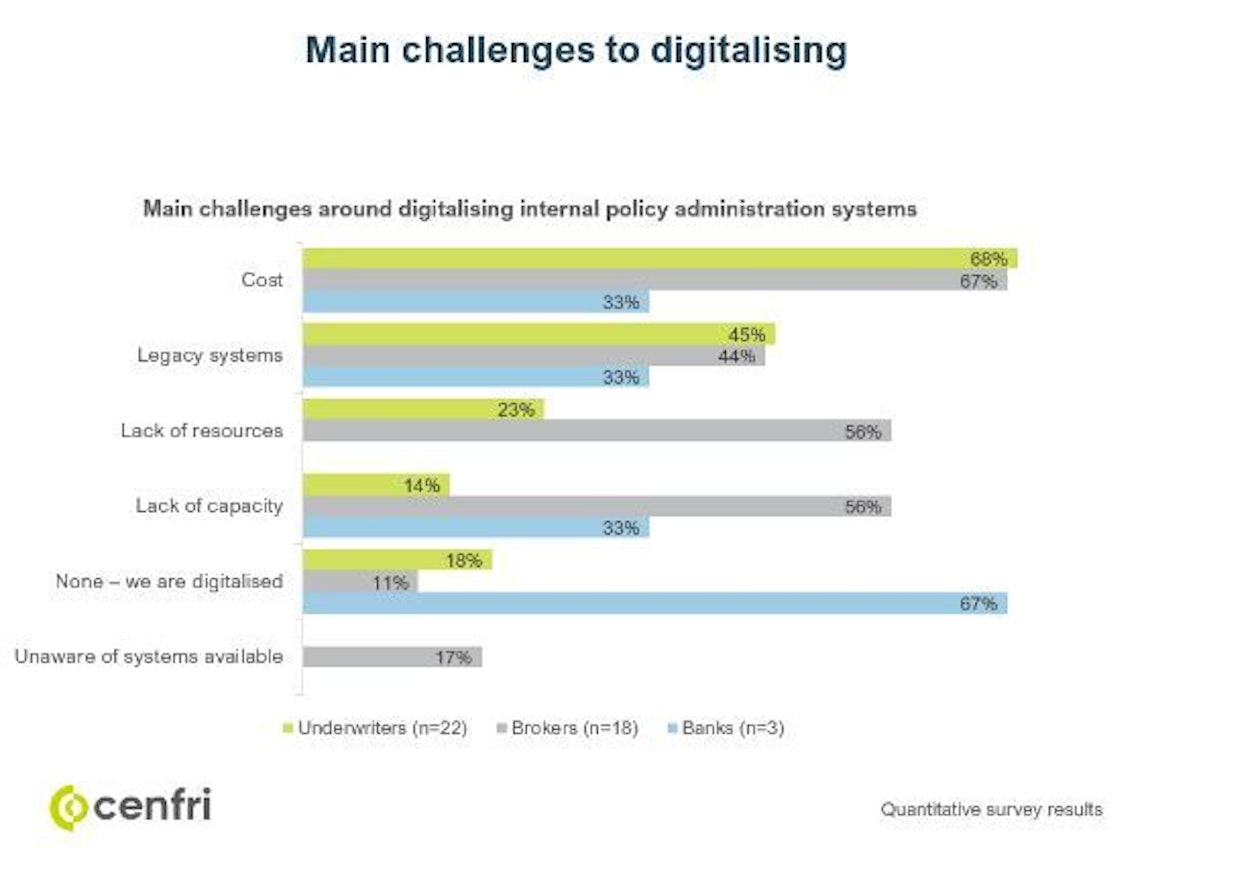

In addition, insurers tend to have costly, inefficient, and outdated legacy systems. The resulting integration and automation limitations impact the ability of distribution partners to originate and administer new and existing insurance policies effectively and efficiently.

Other major challenges to digitalisation in the African insurance industry include: #

- low levels of trust, awareness, and understanding among customers

- low digital capabilities of customers

- cost constraints.

What slows digitalization in African insurance? #

The main challenges to digitalization in the African insurance industry include: too many paper and manual processes, aging legacy systems, lack of real-time access to data that would produce intelligent insights.

Additionally, underwriters may not have the resources required to implement traditional policy admin solutions with confidence. Challenges faced by under-resourced teams during implementation have led to a failure rate of up to 20% on modernization projects. As a result, the appetite to take on such risks tends to be low.

Liberty Nobula, Founding Partner & Consultant, WHL Consultants

What’s the best way for African underwriters facing resource constraints to modernise their policy administration systems?

#

When the previous generation of policy admin systems were created, the life insurance industry was innovating new types of complex annuity-based products. But changes in the market and the drive towards increased digital sales and service have led to a renewed focus on simplified products, many of which are guaranteed to create issues.

As a result, the need for flexibility, while still a consideration, has become only one of a collection of aligned goals including the need to:

- Increase speed-to-market. The days of spending millions and potentially several years on a new product launch are gone.

- Reduce expenses in response to market pressures.

- Implement APIs and agile core systems that support new digital sales and service solutions.

The customization that used to be a top priority has been overtaken in the African market by the need to modernise quickly and cost-effectively.

How to accelerate new policy admin system implementation #

In this new environment, modernisation can be accelerated by implementing an ‘Out-Of-The-Box’ (OOTB) policy admin system that has a standard configuration based on best practices gleaned from experience with dozens of clients.

These OOTB solutions can be implemented in a matter of months rather than years. They are complete PAS solutions that are ready to go with only minimal gap configuration, which means the implementation time frame is greatly reduced. And, you don't need to spend millions of dollars on the implementation.

Out of the Box policy admin system‒ now a reality #

The popularity of simplified product offerings creates an opportunity to take a modern policy admin system and pre-configure it to meet requirements based on best practices derived from decades of experience with dozens of PAS implementations. In effect, this creates an Out of the Box PAS that can be implemented very quickly relative to traditional offerings, and at lower cost, requiring fewer resources from the underwriter.

What is an Out of the Box (OOTB) policy admin solution? #

Ultimately, the goal of an OOTB policy admin solution is to provide clients with a flexible, scalable, and customizable platform that can adapt to changing business requirements while improving customer experience and reducing costs.

The solution is developed by leveraging experiences and global best practices from partnering clients to create standardized features that can be quickly configured and customized to meet specific needs.

- Simon Richardson, Vice President EMEA & APAC, Equisoft

By using parameterization and configuration instead of developing new technologies from scratch, clients can reduce development time and risk, while making it easier to maintain and update the technology. The focus is on minimizing lead time for launching products to market, automating tasks to reduce lead times, and building trust with customers through an exceptional customer experience.

5 concrete examples of built-in PAS functionality and best practices based on underwriter experience #

Not all OOTB policy administration systems are created equal. When evaluating solutions look for:

1. Underwriting automation #

Simplified applications are reviewed against a set of simplified underwriting rules or assumptions so that approval decisions can be made in real-time.

2. Flexibility of application submission #

Applications can be submitted manually, through a third-party eApp or using the underwriter’s own solution and received directly into the policy admin system. If the application data falls within the acceptance criteria, then approval happens in hours rather than days.

3. Automating information collection and reducing the time spent reviewing an application #

Since applications are automatically evaluated, the time required for manual review is greatly reduced, even in non-simplified product situations. The system is able to automatically collect results from a lab report or a medical exam application, for instance, so that an underwriter doesn’t have to find and review everything. The requirements are ordered so that they flag the key data points that require manual attention, speeding up the process significantly.

4. Flexibility in the evaluation process #

The PAS contains maps that can be configured to suit a company’s underwriting requirements. These criteria can vary from one underwriter to the next. In some cases, the requirements may be similar (i.e. For a $1,000,000 face amount, an exam, blood and urinalysis are needed), but how the results of the tests are evaluated may differ, which affects the applicants rating.

5. Automating service tasks to reduce human touches and accelerate the process #

New business onboarding takes relatively little time as a percentage of the term of the policy. The greater resource allocation goes towards the administration and servicing of the policy over its lifecycle. With very little input processing, a good Common Rules Engine can complete service activities more quickly and efficiently. For example, if a customer wanted to do a dividend option change, it that can be completed within the PAS with little impact, little implementation and not require two or three people to touch that type of transaction.

Wrap up: Equisoft/manage #

In order to reduce manual processes, enhance CX and accelerate product innovation African underwriters need to replace their inefficient and outdated legacy systems. Out of the Box, modern policy admin systems provide the opportunity to consolidate back-office systems into one modern solution even when faced with resource constraints. Underwriters who take advantage of the benefits of modernising their legacy core platforms will become more agile and better able to address changing market conditions in the year to come.