It’s been a decade since TISA Exchange (TeX), the open technical standards to facilitate the electronic transfer of investor accounts/portfolios and the re-registration of assets came into being. It was set up in response to requirements in the Retail Distribution Review (RDR) to transfer client accounts and their assets in-specie between providers in a timely manner.

It was mainly targeted at, what was then called the ‘Fund Supermarkets’. Prior to the introduction of TeX and open electronic standards, moving client accounts between platforms required that all assets in an account had to be sold, the cash transferred and then used to rebuy the assets. Obviously, a cumbersome, time-consuming process that could take months to complete, and one that also caused other issues, ranging from CGT liabilities to out-of-market risk, to additional fees charged to the client.

The first electronic transfer of an ISA and the re-registration of funds within the ISA was completed at the end of November 2012. By the beginning of 2013, the main Adviser Platforms had started to support the TeX legal framework and what is now the UK Electronic Transfer and Re-registration Group (UKETRG) open technical standards framework.

Over the last 10 years, the legal and technical frameworks have continually expanded their scope and coverage from the original Adviser Platforms covering funds and cash transfers only, to covering almost all tax wrappers (ISA, JISA, LISA, most pension types), and an increasing range of asset classes.

The state of TeX transfers in 2022 #

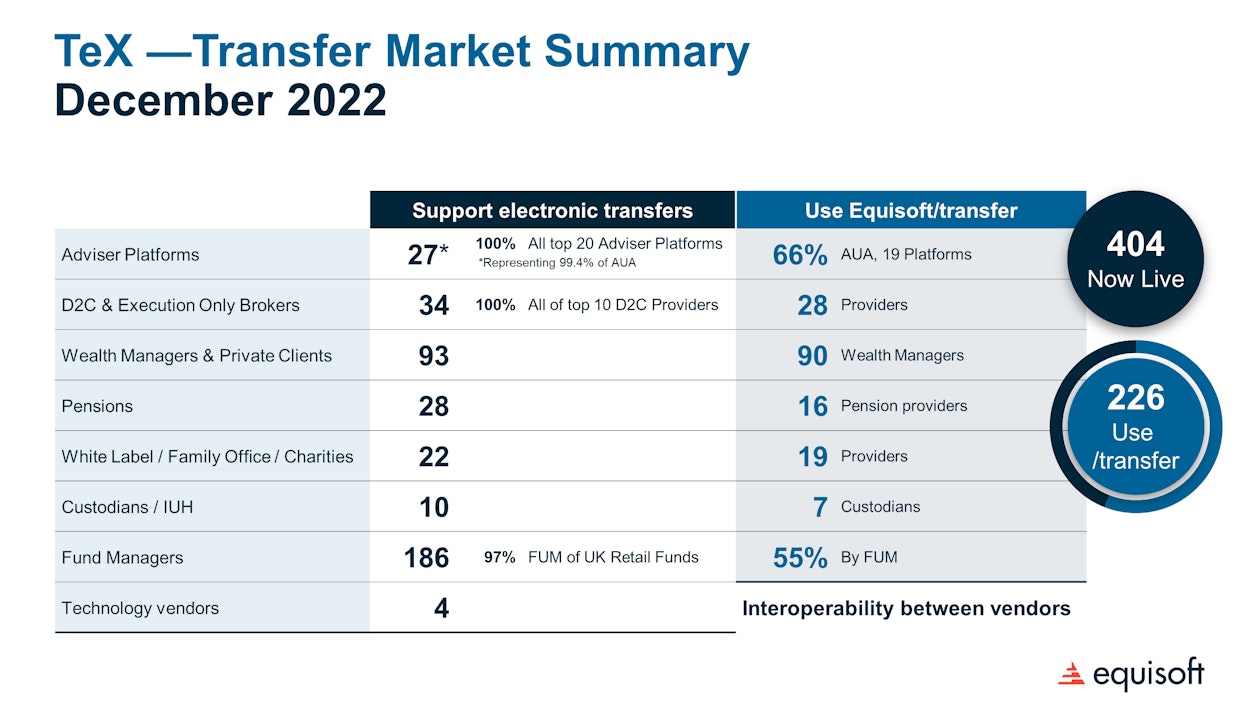

During 2022, the number of counterparties supporting TeX transfer grew to over 400 for the first time, 404 to be exact. Most of the growth in counterparties came from the Wealth Management/Private Client market segment. Despite the growth in the number of organisations supporting electronic transfers, the overall volume of transfer and asset re-registrations dropped by 28% when compared to 2021 volumes. The substantial fall in asset values and the cost-of-living crisis are likely to be the main contributing factors to the drop-in transfer activity.

Market Coverage #

The new participants are major brands in the Wealth Management and Pension Providers market segments. Here is a summary of the coverage in the main market segments:

27 Adviser Platforms, representing 99.4% of AUA, support electronic transfers. #

- All the top 20 Adviser Platforms support electronic transfers

- 19 Adviser Platforms (or 65,5% of AUA) use Equisoft/transfer

34 D2C Platforms and Execution Only Brokers support electronic transfers. #

- All the top 10 D2C providers support electronic Transfers

- 28 use Equisoft/transfer

93 Wealth Managers and Private Clients support electronic transfers. #

- 90 use Equisoft/transfer

22 White Label/Family Office/Charities support electronic transfers. #

- 19 use Equisoft/transfer

10 Custodians/Intermediate Unit Holders support electronic re-registration. #

- 7 use Equisoft/transfer

186 Fund Managers support electronic re-registration. #

- representing 96.5% of UK Retail and Private Clients Funds by FUM

- 47 (or 55.3% by FUM) use Equisoft/transfer

28 Pension Providers support open standards based electronic transfers and re-registration #

- 16 use Equisoft/transfer

New developments in electronic transfers #

In September 2022 a major upgrade to the TeX/UKETRG open standards was completed successfully. The upgrade dramatically extends the asset classes that can be re-registered electronically, growing from 2 (UK Funds and CREST Securities) to 29, including multi-currency. During 2023 we will see vendors rolling out new capability to support the wider range of asset types and classes, speeding up investor transfers even if they have cross border funds, bonds or foreign exchange traded assets.

The other development during 2022 was the first live transfers of corporate occupation pensions electronically using TeX/UKETRG open standards. Backed by some of the UK’s leading Employment Benefit Consultancies (EBCs) this is a major expansion of the use of the open transfer standards that will benefit corporate pension scheme members.

Read about the status of the investment transfer market in 2023.