The good news is that the IFRS 17 compliance deadline is January 1, 2023. The bad news? That’s not the deadline you should be focused on.

IFRS 17 is the biggest set of standard changes in a generation—and the complexity of the project required to achieve compliance is correspondingly daunting. Because of the IFRS 17 data requirements and reporting changes, implementation of a solution will affect almost every aspect of the organization.

—Marvin Yorke, Subject Matter Expert, IFRS 17 Insurance Contracts

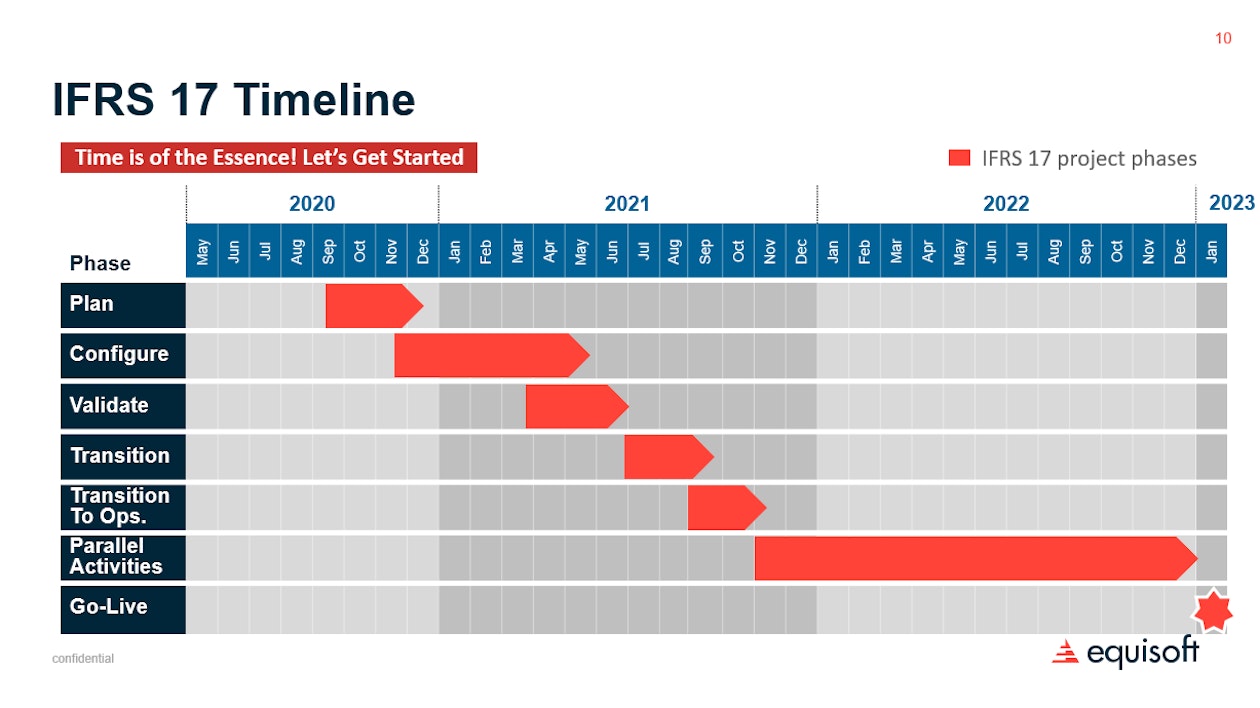

The real deadline is 2022—your IFRS 17 transition year #

To be ready for 2023 you ideally need to have completed your implementation in 2022 in order to generate the results for the 12-month transition period. During that year leading up to final launch, you need your solution up and running so that it can generate the required data and reports. This gives a carrier time to compare the new outputs against IFRS 4. Problems can be identified, and corrections made, before the solution goes live.

—Joseph Sidaros, Senior Consultant, LIMRA International

A critical element in the success of this phase of the project is bringing in your auditors at the outset. They can review the controls and processes associated with the new solution, and, again flag and address any discrepancies.

Early auditor engagement is so important because IFRS 17 is not a black and white, clear cut set of standards. Implementation of a solution will involve a lot of judgement calls from the management team. All of those need auditor approval. And that should come early in the process so that you’re not scrambling to make major changes as the deadline nears.

This transition period is also the best opportunity for an organization to address an important, but sometimes overlooked aspect of navigating a significant change—training all impacted staff on new systems and processes. The 12-month window gives your organization the chance to become familiar with the new workflows and raise any critical issues.

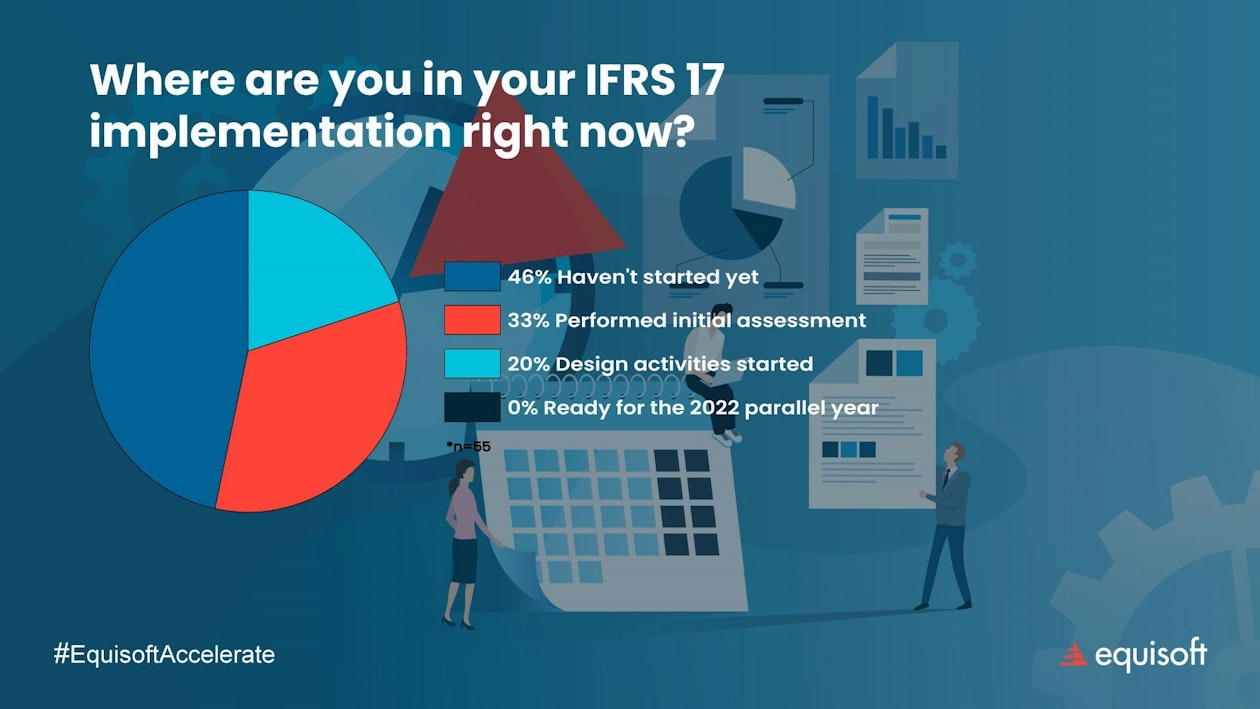

Where is your company in its IFRS 17 implementation timeline? #

Given the necessity for a significant transition period, the implementation timeline becomes tighter than some carriers may have anticipated.

The ideal timeline for IFRS 17 implementation shows that planning should have already been completed in 2020 and configuration should be underway.

Unfortunately, respondents to a poll in our recent Roadmap for Successful IFRS 17 Implementation webinar in the Caribbean and Africa, revealed that the majority of them had yet to begin, and none were far enough ahead that they were ready for the 2022 comparison/parallel year.

IFRS 17 implementation challenges faced by carriers right now #

We also asked attendees, “What is the biggest IFRS 17 challenge you’re facing?”

IFRS 17 data challenges #

The biggest problem area for insurance leaders in the region was IFRS 17 data challenges. That’s not surprising given that the new standards require insurers to access data from every part of the organization, in order to complete the calculations that need to be made on every policy. Access to the right data is needed for projections on future premiums, claims and reinsurance. Data will drive how policy profitability is evaluated. And it influences decisions on assigning policies to the correct portfolios, groups and cohorts.

The new regulations and reporting platform require better quality, clean and easily accessible data than is currently needed. For those insurers with policy data on multiple legacy policy administration systems (PAS) it will be difficult to pull together the information needed to achieve compliance. The new standards place extra demands on many core systems around the organization. Finance systems, actuarial systems, policy administration systems will need to be highly interconnected, and will need to produce more granular data than has traditionally been used.

IFRS 17 data requirements are a client engagement opportunity #

Achieving IFRS 17 compliance is not just an expense. The changes that will need to be made to core systems and a company’s ability to access its data will also create opportunities for growth going forward. At the base level, the IT infrastructure modernization that may take place will also accelerate a carrier’s ability to make product changes or develop new products. Better access to all of the company’s data will enhance decision-making and foster deeper understanding of its clients.

Those benefits create the potential for better client engagement. Consider that client information that is captured as part of information gathering can be used in a CRM to add value to marketing efforts.

Wrap up: Start your IFRS 17 implementation today #

The most fundamental thing to say about IFRS 17 today is that, if you have not started, now is the time to begin. If you have not already, the best first step to take would be to conduct a study that identifies the data gaps that will need to be addressed and strategies for resolving them.

Getting this kind of clarity on the full scope and impact of the transition to IFRS 17 is very important. Some executives are still underestimating the implementation challenge ahead of their organizations. In some cases, they haven’t realized the resource demands that achieving IFRS 17 compliance will place on their company. Conducting a study as part of the initial planning is good way to get all stakeholders engaged and sharing a common understanding of the project.

There will unlikely be any more extensions. The start of the IFRS 17 comparative period is now less than one year away. Putting off your compliance initiatives is really no longer an option.