Life insurance distributors advisor value proposition #

A distributor’s value proposition clearly describes what unique benefits it provides for its target advisor audience. An effective proposition shows agents how the distributor can solve their biggest challenges and it is a point of difference that sets the distributor apart from their competition.

It answers critical questions like: How does the agency add value to advisor businesses, how do they remove frustrations, how do they help advisors grow their practices?

What value proposition is most relevant today? #

Today’s advisors put value on partnerships with distributors who demonstrate deep understanding of advisor challenges and provide solutions that will drive growth. The distributor value proposition should clearly communicate exactly how this will be accomplished.

The first step in crafting your value proposition is to define your vision for advisor engagement. This begins with looking at how you and your organization see advisors working 3-5 years in the future.

What are the most significant changes compared to today? How will advisor activity be streamlined? What higher-value tasks will they be focused on? Who will they market and sell to? How will they work and communicate? Who will be their competition?

To turn the answers to these questions into a vision that describes a high-value future for advisors who work with you drill down and ask specific questions about how you can add value in each area. For example:

- How can we help advisors grow their manage and grow their practices?

- What technology can we provide to enhance their business management capabilities?

- What solutions could help them increase marketing, sales and service effectiveness?

- What platforms or integrations could we provide to increase their efficiency and productivity?

- How can we remove roadblocks and reduce frustration in critical processes?

4 trends that impact today’s value proposition #

When defining your vision for advisor engagement consider how the following four trends influence what advisors need:

Trend 1: ‘Digital packaging’ of advisor experiences #

Industry stakeholders are replacing traditional workflows that underpin distributor, advisor and carrier interactions with new, automated processes that are seamless, highly efficient and more effective.

As the speed of business development increases we’re seeing an increased tendency for distributors to create digital packages of processes, services and technologies that work together to create even greater efficiencies and solve even more advisor challenges. This packaging of solutions becomes the core of the compelling advisor value proposition.

Trend 2: Distributors become technology curators #

Advisors are faced with a wide variety of choices when it comes to software solutions, making it difficult to make the right decisions on their tech stack. Especially for those who are not especially tech-savvy.

The opportunity for distributors is to play a curating role, evaluating new technologies and making recommendations to advisors about the best solutions in every problem area. This is why distributors are increasingly making technology solutions available to their advisors as part of their value proposition.

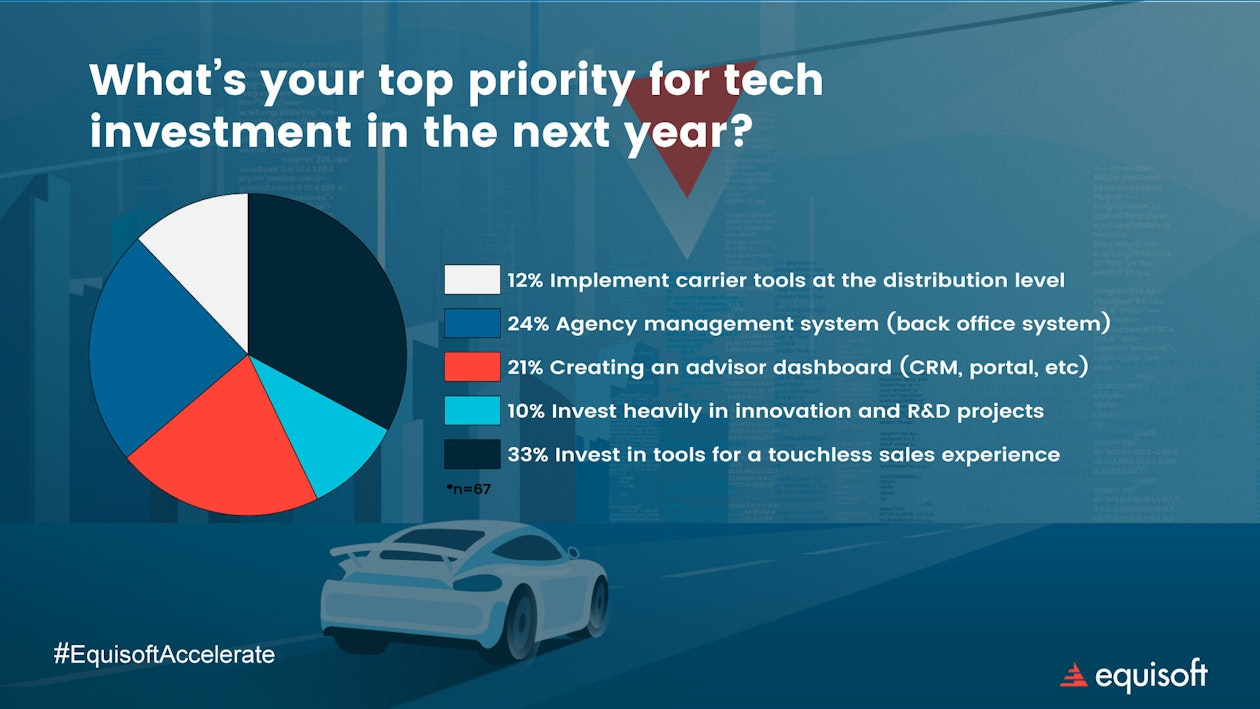

In our Equisoft Accelerate Series Webinar: The Digital Future Of Distribution – P.S. It's Happening Now we asked attendees what their top tech priority was:

These answers are consistent with what we see in the market, as distributors add value by identifying the types of solutions that create the most value for advisors and offering the best-in-class products to remove a host of advisor headaches—like data entry, compliance record keeping and activity scheduling.

Trend 3: The industry is an ecosystem—so is an advisor’s tech stack #

Advisors, distributors, carriers and clients are interconnected like never before. Distributors who are savvy about the increase of connectivity are creating fully integrated, digital software eco-systems that act as productivity multipliers because of the ability to flow data seamlessly between applications. This approach creates complementary efficiencies by integrating advisor apps within the advisor’s practice—and also with distributor and carriers’ core systems.

As the level of integration increases, advisors see dramatic efficiency and productivity improvements. For instance, a typical integrated offering might link an advisor-specific CRM to a state-of-the art needs analysis tool, both linked to the agency management system. All client information will be centralized for the advisor. Activity tracking, compliance, opportunity identification and many other critical processes are more automated, freeing advisors to spend more time in front of their clients.

Trend 4: Value propositions are becoming more data-driven #

Insurance is increasingly becoming a data-driven industry. Some of the remaining challenges to creating greater efficiency and value for all stakeholders are access to data, and ensuring it flows through the chain.

Distributors are addressing these issues by adopting Agency Management Systems that centralize carrier feeds. It can mean connecting to advisor sales and service tools like CRMs and portals, so that advisors have access to accurate data in real-time.

Increasingly data is becoming the foundation of compelling advisor value propositions. Distributors and carriers are working together to harness the vast volumes of data they’ve collected for generations to add value throughout the value chain.

Putting the trends together #

The modern distributor value proposition for advisors is digital. It’s supported by integrated technologies and real-time access to data. It is future-focused, advisor-driven and continually evolving. The best offerings will create meaningful differences in the lives and businesses of top advisors—and energize distribution for years to come.