Marty Ellingsworth, Research & Advisory - Data and Advanced Analytics, Celent

Understanding the true picture of how insurers are using their data #

Data has the potential to transform the life insurance industry. We hear the message loud and clear at every convention, in every webinar and in a flood of articles, white papers and videos. Big data and AI will revolutionize our very traditional business. Analytics will create opportunities for next-level customer engagement.

And yet—most insurers have not realized these benefits in their own organizations.

For all the talk about re-defining data as a strategic asset and morphing into a data-driven business, many carriers are still living in a reality that is more akin to the quote that opened this section.

That’s why Equisoft partnered with Celent to conduct a comprehensive data research project with North American Life Insurance CIOs. We wanted to understand the size and nature of the gap that seems to exist between the data hype and the realities on the ground. We wanted to uncover what CIOs are actually doing with their data today, what challenges they face in leveraging data and what their priorities are for their next data projects.

—Equisoft & Celent Research: Getting Value From Data

3 Concrete ways CIOs are getting value from their data today in IT, Operations & Underwriting #

1. How data increases efficiency in operations and IT #

While the research revealed many ways in which CIOs are prioritizing projects, addressing data challenges and getting value from their organization’s vast volumes of data, in this article, we’ll focus on two areas they cited as most important today: IT, operations and underwriting.

Data creates value throughout the policy life cycle.

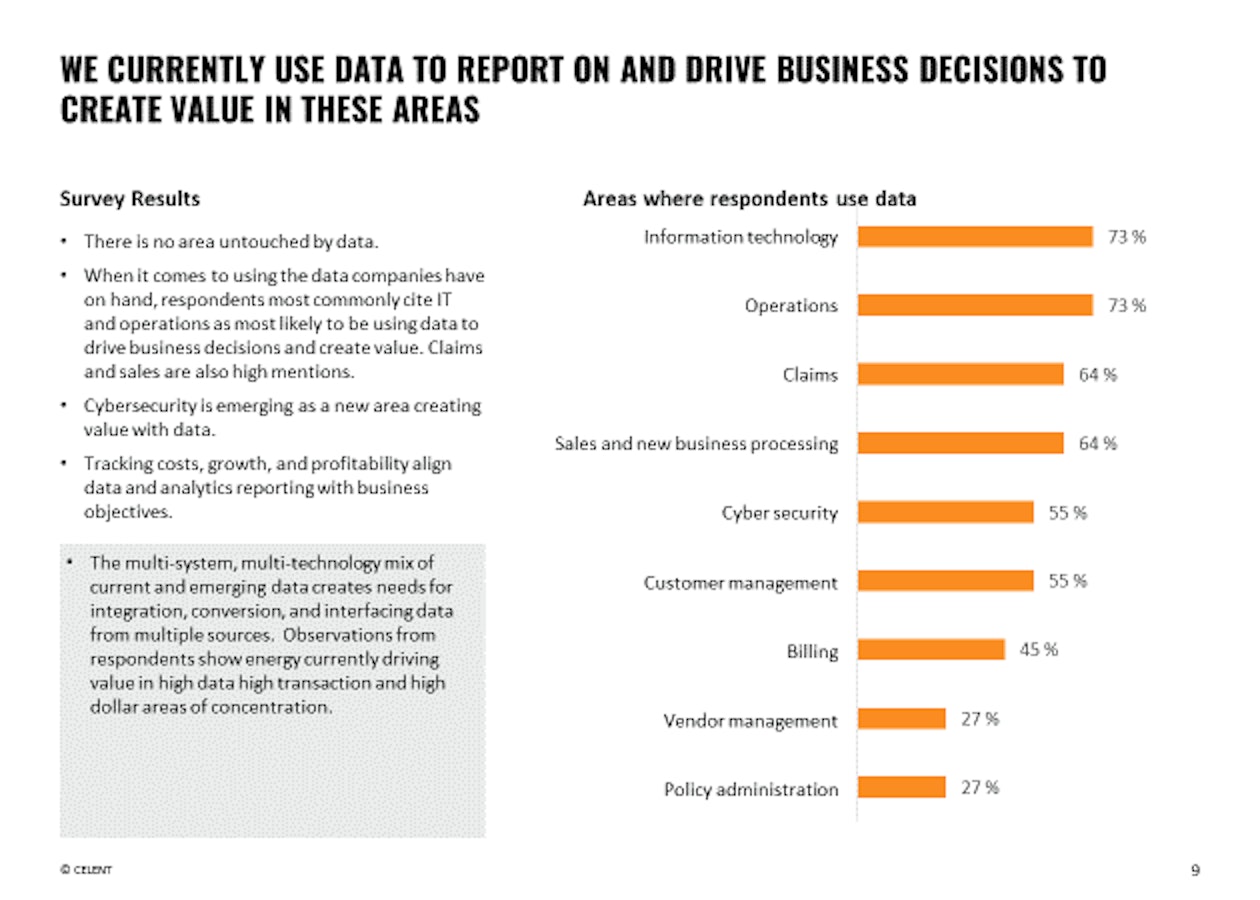

CIO responses to the research show that there is no part in an organization that is untouched by data. It has importance throughout the entire policy lifecycle, and beyond.

For example, purpose-built advisor CRMs enable advisors to easily mine the data from their books of business to segment their client base and efficiently target their marketing to improve prospecting and conversion.

These same advisor CRMs, when integrated with needs analysis tools, are streamlining the sales process by automating data collection and using that data in analytics that generate compelling plans that are more likely to be accepted by the consumer.

Digital front-end solutions like quote and illustration software, and eApplications make it easy to create compelling product recommendations that translate into electronic policy applications. This not only creates great customer experience during the sales process, but this accelerated data flow, speeds approvals and makes Straight Through Processing (STP) a reality for some.

Post application, easy access to real-time data in agent and client portals improves the speed and effectiveness of many service activities and gives clients autonomous control over their information.

If a claim needs to be filed, the easy ingestion of data relevant to the claim and the automated analysis of that information can reduce fraud, speed payments and decrease carrier resources devoted to investigation.

2. Increasing visibility into processes and operations through reporting #

When data is freed from legacy system silos it can give companies insights into the metrics that are critical to meeting their business objectives. Real-time access to relevant data brings increased visibility to cost tracking, growth rates and profitability, for instance. For some companies, operational effectiveness and workflow tracking has been very valuable. Since policy management is a large part of the effort involved in the managing and servicing of insurance products, significant gains can be found by tracking things like:

- Items completed

- Time spent completing tasks

- Workflow tracking—who attempted a task, and how many times before completion

- How many items were completed by a person?

- Volume of tasks for each department

Being able to access the right data in real time for use in analytics, delivers clear measurements that definitively indicate the effectiveness of the process, and enable more effective decisions to be made more quickly.

In more extreme, but very real scenarios, new reporting standards and regulations like IFRS 17/LTDI have redefined insurers’ approaches to their data. These regulations require collection of data at new levels of granularity. And the information must be suitably formatted such that it is ready for use in analysis and report generation. Ahead of the looming regulatory deadlines, most insurers have already begun to integrate multi-system, multi-technology sources to discover, validate, transform and integrate the required data to increase the accuracy and fairness of their financial reporting.

3. Enhanced actuarial pricing and automated underwriting models #

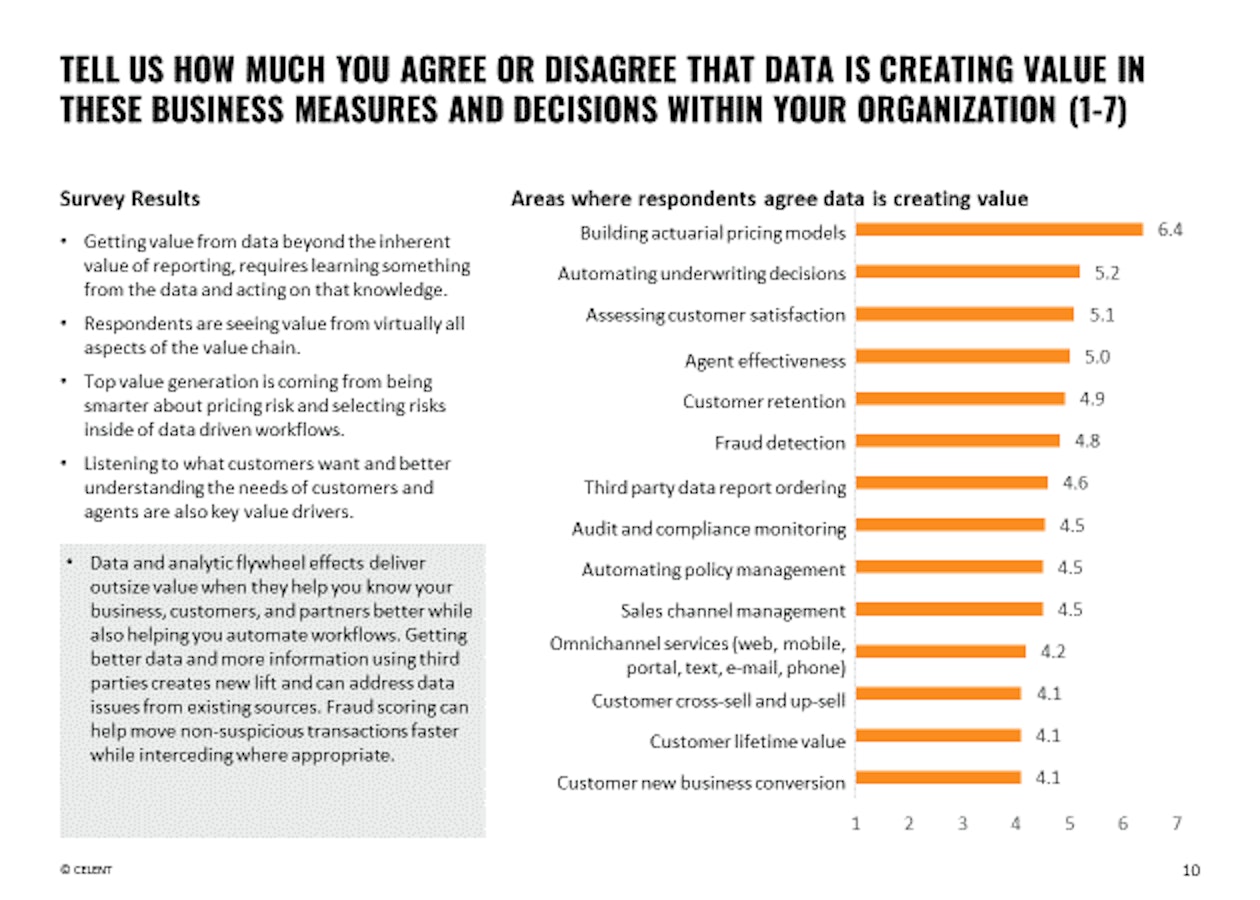

Getting value from your data, beyond visibility and management improvements, made possible by enhanced reporting, requires a further step—that the data is analyzed and some wisdom derived so that it can be acted upon or enable decisions to be made.

When CIOs were asked about how data creates value when making specific business decisions within their organization, the strongest benefits were seen in building actuarial pricing models and automating underwriting decisions.

These are the two areas where companies are finding high value in learning more about the nature of the risks they are underwriting, so that pricing can be optimized and certain risks can be automatically accepted.

Enhancements in underwriting and pricing are made possible, not just by accessing and leveraging the organization’s own data, but by engaging third party data sources. Client data is melded with information from a variety of public and private inputs, such as census reports, prescription histories and medical records.

Applications that used to take up to 30 days to underwrite can now be addressed more accurately, within minutes. In many cases, invasive interactions, like medical exams or phone interviews, are no longer necessary. Carriers can compile 360-degree views of clients in almost real time. And that data can be applied to a model for instant assessment.

Wrap up #

While the hype continues to build around the possibilities for a data-driven future for carriers—one governed by AI, in which interactions are hyper-personalized, automated and infallible—real value is being realized today by organizations leveraging their data to solve real-world problems. The integration of systems through the policy lifecycle and the movement of data between those systems is enhancing the value at each stage in the journey. Better reporting is leading to better decision-making and management across the board. And, underwriting of risk is becoming faster and more accurate.

To find out about more ways CIOs are obtaining value from their data—from understanding customer needs, to product development, to creating superior experiences—download the full research report.